Lower surplus, higher prices could help reduce arrears to farmers in poll bound U.P. and Punjab

Unseasonal rains in Uttar Pradesh and a higher diversion to ethanol production are likely to result in a drop in sugar production this year, according to industry estimates. With average retail sugar prices also on the rise, a reduction in surplus sugar could help speed up cane payments by mills and reduce their pending arrears to farmers this season.

Late payments and arrears have become a political flashpoint recently, especially in the poll-bound States of U.P. and Punjab. At the end of July, when the latest data is available, arrears to farmers stood at ₹2,417 crore.

Retail sugar prices are up 5% in comparison to last year. Delhi alone has seen retail prices spike over 13% in the last three months, according to monitoring by the Consumer Affairs Department.

Based on satellite images taken in the second week of October, the Indian Sugar Mills Association (ISMA)estimated that 54.37 lakh hectares has been sown with sugarcane this year, about 3% higher than during the previous season. However, the increased acreage is unlikely to translate into higher production.

Due to heavy and untimely rainfall in U.P., especially in the eastern part of the State, yield and sugar recovery are both likely to fall this year. The first advance estimates pegged the production at 113.5 lakh tonnes.

Highest sugar producing State

Maharashtra is likely to overtake U.P. to become the highest sugar producing State this year, boosted by good monsoon rainfall and sufficient water availability in the reservoirs. Although ratoon cane availability is higher than plant cane, meaning that yield per hectare is expected to be slightly lower in comparison to last year, ISMA estimated production to be about 122.5 lakh tonnes.

Sugarcane acreage and yield are both higher than last year in Karnataka, which is expected to produce 49.5 lakh tonnes. The remaining States are expected to collectively produce 53.1 lakh tonnes.

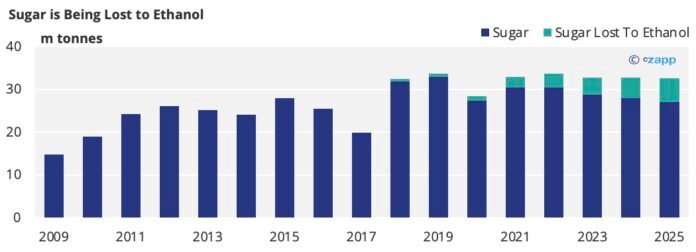

As the 339 lakh tonnes to be produced is significantly higher than last year’s domestic sales of about 266 lakh tonnes, the sugar industry depends heavily on exports and diversion to ethanol production to reduce the surplus. ISMA estimates that the diversion of sugarcane juice and B-molasses for ethanol will reduce sugar production by 34 lakh tonnes, 13 tonnes higher than last year, and hopes for exports of at least 60 lakh tonnes.