US ethanol exports totalled 1.3 billion gallons valued at $2.3 billion in 2020, according to figures from the US Department of Agriculture.

This total volume was 9% lower than 2019 due to reduced demand for fuel use, and 2% below the record 1.7 billion gallons shipped in 2018.

Year-over-year value fell only 1% due to higher prices for fuel ethanol and increased shipments of higher-value, medical-grade ethanol.

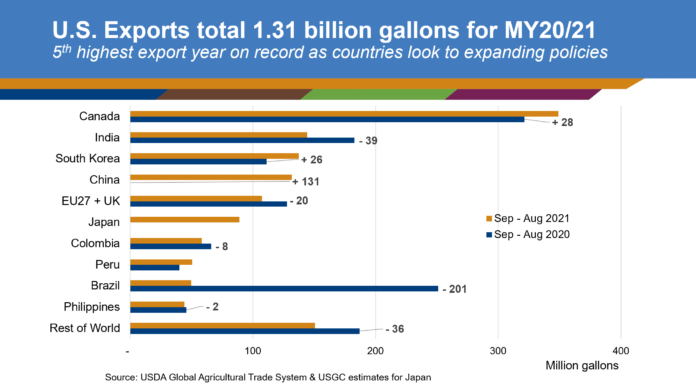

US fuel ethanol to Brazil saw the largest absolute decline in 2020, due to Brazil’s COVID-19 impacted fuel market and a 40% depreciation in Brazil’s currency.

The South American country’s 20% import duty continued to impact the market.

Export volumes were also lower than expected to other fuel markets last year, most notably the Philippines, Colombia and Peru.

Sales to Canada held mostly steady as US suppliers backfilled Canada’s increased sales to Europe. By contrast, U.S. fuel ethanol sales to mainland China rose from zero to 21.2 million gallons. Sales to Hong Kong added 10.5 million gallons.

Differing from fuel ethanol markets and driven by demand for hand sanitiser, US exports of other industrial and consumer ethanol rose, most notably to Mexico- up $67 million (€56 million) and Nigeria – up $25 million (€21 million). For the remaining top 10 markets, ethanol sales rose to the EU27+UK on strong demand for hand sanitiser and high local fuel ethanol prices, industrial ethanol sales to India inched higher to a record $312 million (€263 million), and industrial ethanol sales to South Korea dropped as China covered South Korea’s demand for medical-grade product.