New Delhi: Credit Rating agency Crisil Ratings projected a promising outlook for Indian sugar mills, with expectations of steady operating profitability for integrated mills amid market fluctuations. In a report, the agency said that key contributing factors include a surge in domestic sugar prices and rising sales of ethanol.

It has projected a stable operating profitability for integrated sugar mills in India, despite facing hurdles. The report highlights that higher domestic sugar prices and increased sales of ethanol are expected to offset the rise in sugarcane costs and reduced exports during fiscal year 2024.

According to the report, domestic sugar prices have surged by around 5% between March and June this year, reaching ₹34/kg, following two years of steady rates at ₹32/kg. The rise in prices can be attributed to an estimated 7% decline in total sugar production during the current season ending 30 September, primarily due to unseasonal rains adversely affecting major sugarcane-growing regions such as Maharashtra and Karnataka.

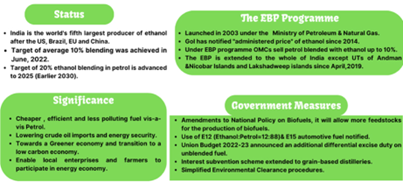

The report has forecast that sugar prices will remain at current levels in the short term, with only a modest increase in net sugar production expected for 2023-24 (October-September), as more sugarcane is diverted towards ethanol production. The estimated ethanol diversion is set to rise to 5 million tonne compared to 4 million tonne this season, signaling a positive trend for the ethanol market.

Poonam Upadhyay, director, Crisil Ratings, said, “Tailwinds from steadily growing ethanol volume and better realization, supported by the government’s policy, will offset the impact of higher cane prices.”

Upadhyay also noted the recent improvement in domestic sugar realizations, which will help maintain operating profitability at integrated sugar mills at 11-12% during fiscal 2024, compared with 11% achieved in the previous fiscal, despite lower export volumes.

The entire sugar value chain, including sugarcane procurement prices, monthly sugar distribution, annual export quotas, and ethanol prices, is closely regulated by the government as an essential commodity.

The Cabinet Committee on Economic Affairs recently approved a 3.5% increase in the fair and remunerative price (FRP) for sugarcane, which is set at ₹315 per quintal for the next season. Furthermore, ethanol prices are anticipated to see a modest increase, in line with the historical practice of adjusting them based on changes in cane prices.

However, the report also highlights challenges faced by sugar mills that primarily depend on sales and lack of distillery facilities. Due to the surge in international sugar prices, currently 55% higher than domestic prices, these mills have already exhausted the export quota of 6.1 million tonne for the current season, leading to a 46% year-on-year decline in exports this season.

The analysis conducted by Crisil Ratings encompassed 24 sugar mills, with a collective revenue of ₹41,000 crore in the previous fiscal year.

Anil More, associate director at Crisil Ratings, expects the credit quality of integrated millers to remain relatively stable, attributing it to steady cash flow generation and effective management of working capital requirements.

More said that any increase in debt levels would primarily be associated with companies expanding distillery capacity for ethanol production. Despite challenges, the continuing interest subvention scheme is expected to mitigate the impact of higher overall interest rates, limiting the decline in interest cover to 6.4 times in fiscal 2024, compared to 7 times in the previous fiscal year.