In his address to the nation on India’s 75th Independence Day, Prime Minister Narendra Modi emphasised the need to transform India to an “energy independent nation” before completing “100 years of independence”, stressing on the country’s transition towards cleaner sources of energy, such as bio fuels. In this context, he also reiterated the target of 20 percent ethanol blending (E20) by 2022, as envisaged under National Policy on Biofuels – 2018.

In January 2003, the government of India had launched Ethanol Blended Petrol (EBP) programme for sale of 5 percent ethanol-blended petrol (E5) in nine states and four Union Territories. Later it was extended to 11 other states in 2006. However, the programme had limited success till 2014 with 0.1-1.5 percent average blending, largely due to limited availability of feed-stocks, high taxation, and limited investment of ethanol projects (MoPNG, 2021).

Post 2014 saw a series of government interventions in the form of simplified tendering process by Oil Marketing Companies (OMCs), reduction in tax from 18 percent to 5 percent, approval of alternative feedstocks like food grains and agricultural waste and interest subvention schemes. Further, in 2018, GoI notified the National Policy on Biofuels (NPB) wherein an indicative target of E20 by 2030 was laid out.

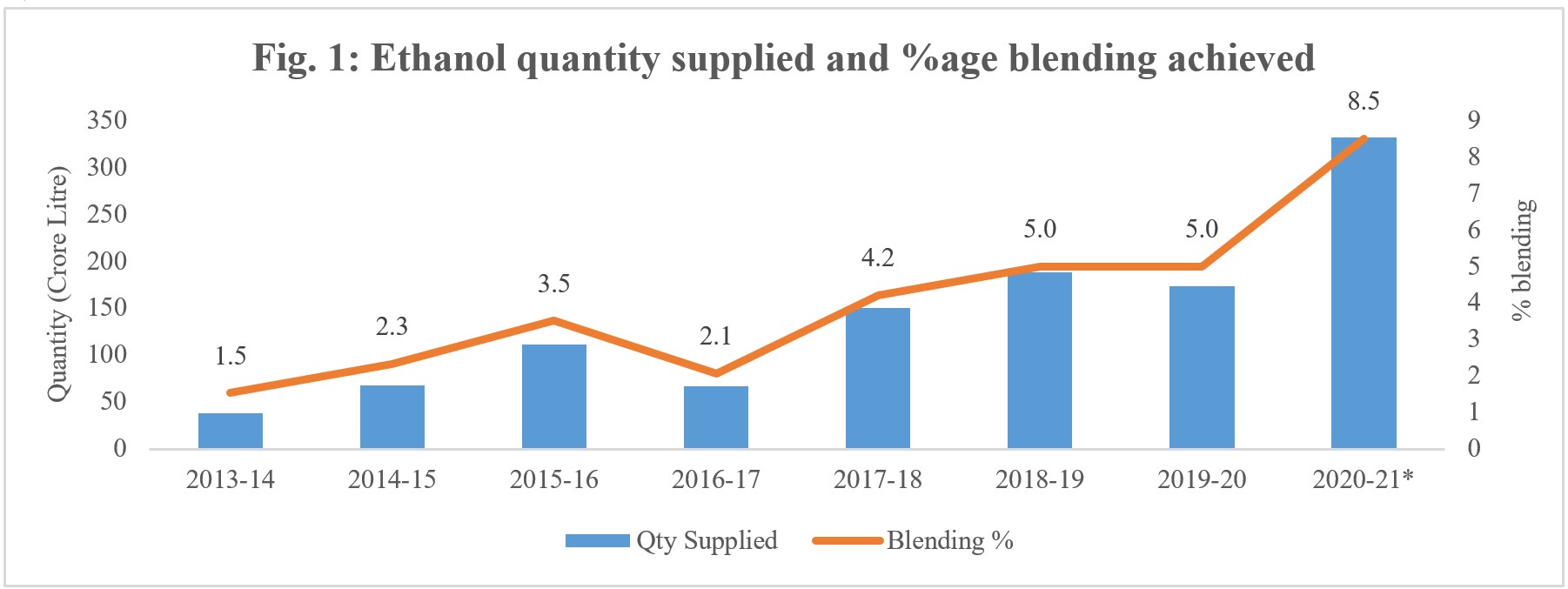

Due to growth in both quantity of ethanol supplied to OMCs and the percentage of blending over the years (see Figure 1), the government preponed its target of E20 from 2030 to 2025, and E10 to 2022. However, India produced only 485 million gallons in TE2020, against an annual demand of almost 1 billion gallon, and the rest is met through imports mainly from the United States (DOE, 2021b).

Of the 173 crore liters of ethanol produced domestically in Ethanol Supply Year (ESY December-November) 2019-20, about 91 percent came from sugarcane and the remaining 9 percent from maize – 74.12 crore liters came from C-Heavy molasses, 68.14 crore liters from B-Heavy molasses, 14.83 crore liters from sugarcane juice and 15.08 crore liters from maize (NITI Aayog 2021). In the current ESY, 332 crore liters with 8.5 percent blending is expected. In this context, with an aim to achieve its E20 target by 2022, the government has allowed surplus stock of rice from the central pool (with Food Corporation of India (FCI)) to be brought under ethanol production (PIB, 2020).

Food to fuel: The case of rice

This year itself, the government had allotted 78,000 million metric tons (MMT) of rice from FCI’s stock to distilleries at a subsidized rate of Rs.2000/quintal (Hussain & Mohapatra, 2021), and has very recently announced a planned utilization of about 17 million tons of foodgrains towards achieving E20 by 2025 (ISMA, 2021).

The central pool of rice stock (49.1 MMT including 19.4 MMT of rice converted from paddy as on July-2021) is way above the buffer stock norms (13.54 MMT) (DFPD, 2021a), and the costs of maintaining this surplus stock has been constraining the state exchequers (Gulati, 2020). While the diversion of the surplus stock to an alternative use, like ethanol blending may provide some respite to the state coffers, the concerns associated with such diversions may not be totally unfounded.

Despite its bumper food grains production, India ranked 94 out of 117 countries in Global Hunger Index – 2020. This raises the question as to whether using the rice stock for schemes like PM Gareeb Kalyan Yojana, for which government has allotted 33.86 MMT in 2020-21 and 28.28 MMT in 2021-22, would be a more prudent choice than diverting it towards ethanol production. Besides, excess rice in central pool stock can also be used for strategic diplomacy in countries, which are facing shortage of food grains.

However, use of damaged food grains for ethanol production is a progressive step. Yet, it is doubtful if it can help achieve the target of E10 or E20, as the quantity of damaged food grains with FCI is very limited. In TE2019-20, the quantity of damaged food grains in FCI warehouses was only 0.03 lakh MT (MoCAFPD, 2020).

But a major concern about this diversion rests on the fact that the price of Rs 2,000/ quintal, at which distilleries can procure this stock, is lower than the derived minimum support price (applying 0.67 conversion ratio of paddy to rice, to paddy MSP of Rs 1,940/quintal) of rice at Rs.2895.5/quintal, as well as the economic cost of Rs 4,293.8/quintal quintal (Hussain & Mohapatra, 2021). This, in turn, could be counter-productive for policies for diverting acreage under water-intensive crops like rice (requiring 4000 liters of water for a kg of rice) towards more diversified agriculture (Sharma, et al., 2018).

Mills to distilleries: The case of sugarcane

On the other hand, as of 2019-20, 62 percent of India’s ethanol production capacity of 684 crore liters is sugarcane or molasses-based, while only 38 percent is grain-based (NITI Aayog, 2021).

At the same time, a set of price support incentives from the government in the form of the central government’s fair and remunerative price (FRP), state advisory price (SAP), export subsidies, interest subsidy schemes etc., among other things, has resulted in an expansion of the acreage under sugarcane, Consequently, this led to the stockpile of surplus sugar since 2010-11 (except 2016-17 due to drought). Since last five years (2017-18 to 2021-22), production and consumption averaged at 33.2 MMT and 27.5 MMT, respectively, generating a surplus of about 6 MMT (USDA, 2021a).

The surplus sugar affects the ability of sugar mills to clear the arrears of sugarcane farmers, which stood at Rs.14010 crores in June 2021 (DFPD, 2021b). While an increase in the international prices for sugar (White Sugar Price Index) from USD 418.50/ton on 31st March to USD 515/ton on 23rd September (ISO, 2021) and a lower production in Brazil in 2021-22, marks a good opportunity for the Indian sugar mills to export this sugar surplus, the government also provides an export subsidy of Rs. 4000/ton to offload this excess sugar in the global market. However, such government intervention in sugar sector makes it uncompetitive in the international market.

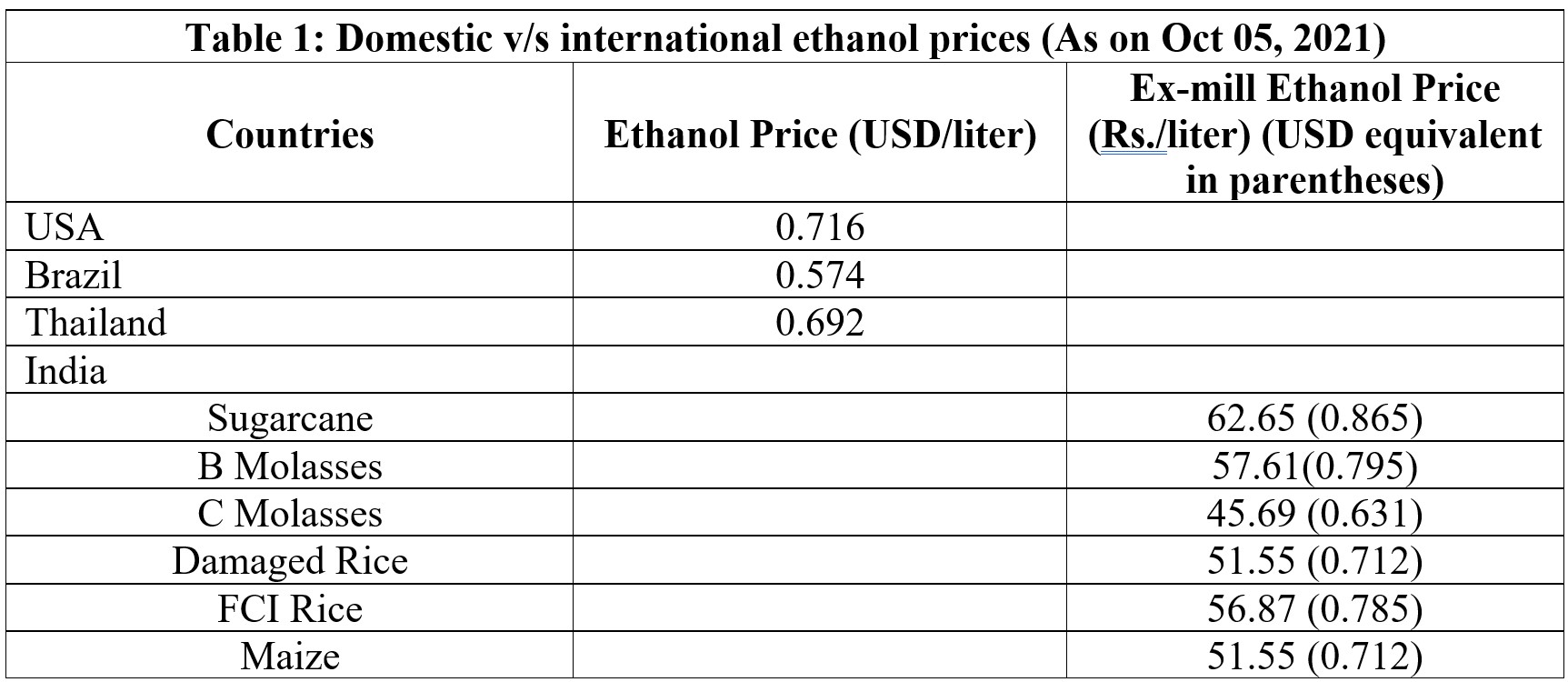

To incentivize sugar mills to divert excess sugar for ethanol and enable them to clear sugarcane farmer’s arrears, remunerative ex-mill price of ethanol (paid by OMCs to the sugar mills) produced from sugar, B-Heavy molasses, C-heavy molasses, sugarcane juice, and syrup have been fixed by the government (PIB, 2020). This incentive is required as the GoI fixed-FRP and state government fixed-SAP makes the cost of raw material (sugarcane) higher than that in other major sugar producing countries. This makes domestic ethanol prices higher than international prices (Table 1).

In order to achieve E20 by 2025, 666 liters of ethanol production is required, for which, a surplus of 6 MMT of sugar will not be sufficient (NITI Aayog, 2021). Further, expansion of the acreage under sugarcane will have ramifications for groundwater water sustainability, given that sugarcane is a highly water-intensive crop. In Maharashtra, for example, where sugarcane occupies only 4 percent of total cultivated area, over 64 percent of irrigation water is diverted to its cultivation (Sharma, et al., 2018).

In 2021, Brazil, largest producer of sugar and the second largest producer of ethanol (with 98 percent of its ethanol production being sugarcane-based (USDA, 2021b), is facing a drought like situation due to improper water management on account of escalating sugarcane production (Dutta, 2021).

Feed to fuel: What chances of corn?

Given the limitations of using sugarcane and rice, in terms of both fiscal and environmental (water) sustainability, is there a possibility of expanding corn-based ethanol production in India?

Bihar, a major producer of corn in India, accounting for 8 percent of the national production of corn in TE2019-20 (DES, 2021), has come up with a state-level policy on ethanol production (Government of Bihar, 2021), to find alternative markets that can fetch remunerative prices for the state’s corn growers, in the absence of a starch and poultry feed industry in the state.

However, a national-level scaling up of corn-based ethanol production is potentially constrained by the fact that 60 percent of our corn production is used as poultry and animal feed (NCML, 2017). Hence any major diversion of corn usage towards ethanol production would severely impact the poultry sector. As in 2021, poultry feed prices (both soybean meal and maize) are ruling high in the country (USDA, 2021c), and any decline in corn availability will further drive up the prices of poultry products via feed price. Moreover, there has been a shortage of corn in the country and India had to import corn during recent years (2018-19 and 2019-20) (APEDA, 2021).

While in the wake of surging crude oil prices in the international market – from USD 21.04/barrel in April 2020 to USD 72.8/barrel in September 2021 (World Bank, 2021)- blending petrol with ethanol will reduce our import dependency of crude oil, the feasibility of our blending programme’s target also needs to be reassessed, especially when we are at the first generation biofuels that use food crops as raw materials.

Diverting excess sugar for ethanol will help the sugar industry in particular, but the pricing policy of sugar based ethanol should not result in higher acreage of sugarcane, especially in water stressed regions like Maharashtra, where 100 percent area under sugarcane is under irrigation (Sharma, et al., 2018). Going forward, the pricing policy of sugar based ethanol should be linked to global ethanol prices and not distorted by support prices and subsidies to the mills or the farm sector.

If policies for agricultural diversification are successful in reducing area under paddy, it is plausible that corn production may go up. However, the production has to be much more than the requirement of the poultry industry for the excess corn to be used for ethanol blending. This will also potentially enable farmers to realize a better price for corn.

Simultaneously, exploring and leveraging the potential of second generation (2G) bio-fuels obtained from non-edible agricultural wastes like corn cobs, stalks, stems, etc. can be more environmental friendly and less threatening for food security. Although, the techno-economic viability of commercial production of 2G ethanol is yet to be tested, but it should be the long-term agenda for a sustainable bioenergy policy.

The above news was originally posted on theprint.in and was taken through aggregated feed.

Harsh Wardhan is consultant and Siraj Hussain is Senior Visiting Fellow, Indian Council for International Economic Relations (ICRIER), New Delhi.

This article first appeared in ICRIER’s quarterly publication, Agri-Food Trends and Analytics Bulletin (AF-TAB) Volume 1, Issue 2.