Sugar producers have seen a significant reversal in their fortunes helped by exports and the government’s boost to promote ethanol production. This has helped the sector tide over the sugar surplus situation to a large extent.

Shares of major sugar producers such as Balrampur Chini Mills Ltd, Shree Renuka Sugar, Triveni Engineering Industries Ltd, Dhampur Sugar Mills Ltd and EID-Parry (India) Ltd have risen 28-142% year-to-date.

The sugar season (SS21) began with a strong surplus. The season is from October to September. Sugar production was expected to surpass consumption by 6-7 million tonnes (mt). Besides, there was an opening inventory of 10.8mt being carried forward from the previous year. What came to the rescue of mills is exports. Export subsidies and rising sugar prices globally were enough incentives for firms to sell stocks abroad.

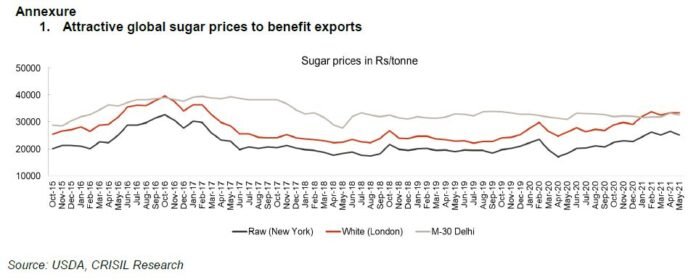

What’s more is that government policies on promoting ethanol production and blending it with auto fuels have meant more diversion of sugar to produce ethanol, encouraging firms to ramp up ethanol capacities. Ethanol and exports have both helped to contain the impact of surplus on prices. Globally, sugar prices are hovering at multi-year highs. Unfavourable climatic conditions in large sugar-producing countries such as Thailand has led to lower production, point out analysts.

Global economic recovery from the covid-induced turbulence has strengthened the cause for a revival in sugar demand.

The Indian Sugar Mills Association has forecast this year’s sugar season to see exports cross the 7mt mark. Meanwhile, sugar mills are holding back on signing new export contracts as domestic sugar prices have surged too. The festive season is fuelling the price rise amid an expected increase in demand.

Meanwhile, the Ethanol Blending Programme continues to gain momentum. Analysts say that 2.43 billion litres of ethanol has been procured at an 8.01% blending rate till date in SS21 and the government has envisaged advancing the 20% ethanol blending target to 2025. This can help reduce the structural over-supply scenario.

“On a sustainable basis, we estimate 5-6mt of diversion through direct /B-heavy route (for ethanol production) provided adequate infrastructure at the depots and issues pertaining to transportation costs are addressed,” analysts at JM Financial wrote in a note.

But there is a flip side. Higher sugarcane procurement prices in the new season is a concern. As such, the Centre has hiked the fair and remunerative price of sugarcane by Rs. 5 a quintal to Rs. 290 a quintal. This has a bearing on state advisory prices (SAP) of Uttar Pradesh and Punjab. This can increase the cost of procurement for mills.

Notably, Punjab SAP has already been increased by Rs. 15 a quintal. Higher-than-expected rise in SAP, which is a risk during state elections, can impact the profitability of sugar producers.